Note: If you don’t care about the history of income tax in the US go ahead and skip to the progressive tax model section below.

So every year around April, every working person has to deal with the stress of filing their taxes. And every year people see how much money is taken by Uncle Sam. You look at the tax brackets and you run the math real quick but that doesn’t seem to add up. So whats going on with our tax system and why is it so complicated? Well like all policy and laws in place today there is a long and rich history behind how things came to be.

History of US Taxation: “The only sure things in life are death and taxes” right? Today we think of income tax as inevitable as Thanos. Thanos’ name is even derived from the Greek god of death, Thanatos. So income taxes have always has been and always will be right? But in reality income tax isn’t as absolute as Thanos or that saying leads up to be. Income tax didn’t exist for the most part before 1913. There was a brief 11 year period during the Civil War were income tax existed in US history. During the Civil War, the North needed more funds to support the war effort; thus, congress passed a bill call the Revenue Act of 1861, which taxed income above $800 at 3%. The following year congress got the taste for money and enacted the Revenue Act of 1862, which taxed incomes of above $600 at 3% and taxed incomes above $10000 at 5%. This is the first example of a progressive tax, which we will get more into later on. Now at this point, you are probably thinking to yourself, even with inflation and such small incomes, 3% and 5% is nothing in terms of income tax. Well you are correct, but just think about the context of this for people in the US at the time. Our country was basically found the principle of fighting against the taxation tyranny of Great Britain. Throughout the infancy of the US, funding the government was a constant struggle since taxes were so vilified just after the revolution. However, 85 years into the American experiment, the Federal government started taking your money from you!?This must have been unthinkable to the populous of the day. So much so, that once the Civil War ended and the government didn’t the money anymore, the Revenue Acts were then repealed in 1872.

Its hard to imagine but throughout the 243 years of the existence of the States, more than half of that has been income tax free. It wasn’t till 1913 with the ratification of the 16th Amendment to the Constitution that the Federal government gained the legal power to collect a tax on incomes. This is what allowed for income taxation to become what we know today as inevitable.

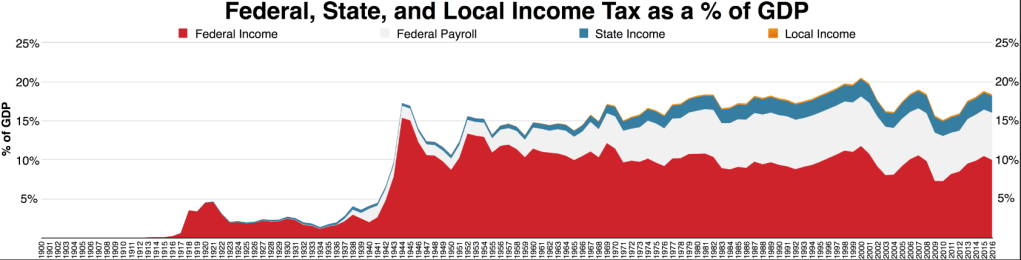

So with the passage of the 16th Amendment, congress wasted no time and passed the Revenue Act of 1913, which taxed incomes above $3000 at 1% and taxed incomes above $500000 at 6%. In 1918, the highest tax rate was then raised to 77% for incomes above $1000000, to again help fund another war, in this case World War 1. So pretty drastic changes in taxation rates for income, but for the vast majority of the population you effective had a flat tax rate at 1%. The taxation rates fluctuated over time for the next hundred years, and I don’t want to just recite numbers to you and a graph I think would be far more concise. See Figure 1 below for a graph of income tax rates overtime.

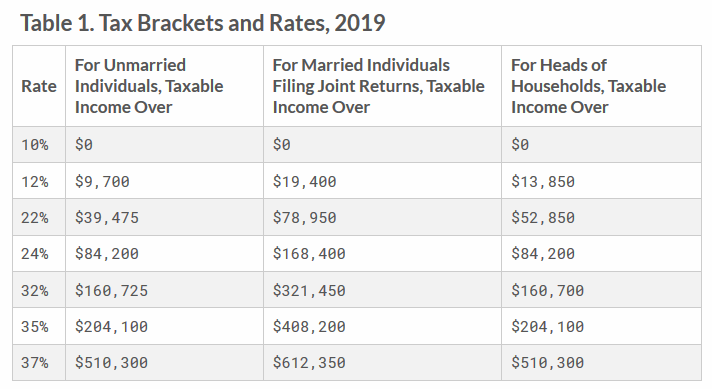

Income Tax Models: As you can see in the graph, income tax on average has more or less been roughly the same since about the 1950 for most Americans, but lets get more granular about the income taxation rates. Below is a Table of the current income tax rates for various incomes, lets break down what this Table actually means.

Progressive Tax Model: I am only focusing on Federal taxes and not state. Lets say you are single making about $50000 a year, so looking at the tax brackets that would put you in the 22% income tax bracket obviously, right? It doesn’t actually, the US tax code works on a progressive tax model, which means the income you make is taxed through the various brackets. So your first $9699 is taxed at 10% then your $9700 to $39474 is taxed at 12%, then your last $39475 to $50000 is taxed at that dredged 22% on paper. But that is not the whole story, you have your standard deduction to your income when you file taxes. What that basically means is that you take your income and subtract $12200 from your gross income of $50000 to have a total taxable income of $37800, which is awesome since that means that you are not even taxed at 22% at all. So what is your effective average income tax rate, ($9699)(10%) = $969.9 and $37800-$9699 = $28101 and ($28101)(12%) = $3372.12. For a total of $4342.02. For a effective tax rate of ($4342.02/$50000)(100) = 8.64%. So with that sweet, sweet deduction right off the top of your income you are effectively paying less than the lowest possible tax bracket.

Another example of effective tax rate for income of $100000 a year or $87800 after the standard deduction would be ($9699)(10%) = $969.9, ($29775)(12%) = $3573, ($44725)(22%) = $9839.5, and ($3600)(24%) = $864. For a total of $15246.2 taxed and effective tax rate of ($15246.2/$100000)(100) = 15.25%. This is almost double the tax burden by percentage then the person making $50000 but still far less then what the Table leads you to believe.

This effective tax rate vs tax brackets I think is what confuses a lot of people on their tax filing. Just know that just because your income is in 22% bracket, doesn’t mean you are gonna have to pay that, and your effective tax rate can be much much lower. Either way though, with the standard tax deduction and the progressive taxation, this model at its core gradually taxes more with the more money you make. Thus, higher earners have more tax burden, while lighting the burden on lower earners, which some (high earners) think is by definition unfair, which they are correct. The progressive model is step up to tax people more as their income raises, the numbers don’t lie. However, a counter point is that since high earner typically have more disposal income they can better afford the larger burden instead of punishing lower income earners who have much less disposal money. Regardless of your opinions on the matter this is the reality of the US tax code, and beyond the super rich taking advantage of certain loop-holes there is no fighting it.

Flat Tax/Regressive Model: That’s progressive tax model, there is also a flat tax where no matter your income everyone gets taxed the same, lets say like 10% across the board. So no matter your income or tax deductions would be taxed the same rate. Lets assume everything else is the same in our tax code and go by a flat tax.

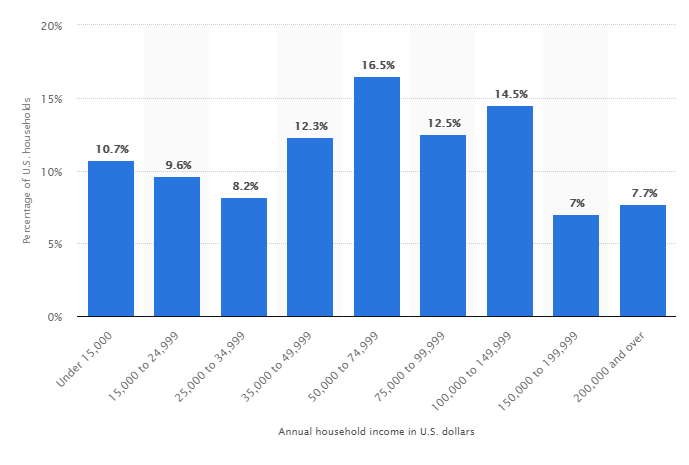

Lets use the same incomes as in the progressive model. For some one who is single making $50000 a year with a $12200 standard deduction means a taxable income of $37800 a year. So taxed at 10%, the math would be much simpler to just ($37800)(10%) = $3780 for a effective tax of ($3780/$50000)(100) = 7.56%. For someone earning a $100000 year, I am going to skip through the math here and it means an a total taxed amount of $8780 and an effective tax rate of 8.78%. So for lower to average American earners this reduces their tax burden slightly about 1.08% at 50k a year but at higher earners it significantly reduces their tax burden by almost half. So this tax system definitely benefit higher earners more, its not unfair exactly either since it even reduces the tax burden of lower earners as well slightly. Even if we look at someone making like $25000 range lets run the numbers on how the flat tax versus progressive effects them. So at $25000 minus the $12200 deduction with the flat tax model that is a taxable income of $12800 at 10% is $1280 income tax, and a effective tax rate of $1280/$25000 = 5.12%. With the progressive model its $969.9 + $372.12 = $1342.02 for effective tax of $1342.02/$25000 = 5.36%. So looking at it this want you might be thinking, “Why aren’t we doing a flat tax? It seems better for everyone.” Everyone benefits to some degree and is objectively more fair, however, something that must be considered is the amount of revenue the Federal government would lose out on. So in this very specific example of a flat tax it is objectively more fair then progressive, however if the amount of revenue collected by the government has to be match in the flat tax model then the story changes drastically. A flat tax that gets up to 15% or higher would start to be come a regressive tax model and starts to become extremely unfair to low earners, and even relatively high earners as well. So with someone earning $50K at 15% flat tax that’s an effective tax rate of 11.34%, you would have to make at least 85K a year to effectively begin to be taxed less overall then in the progressive model. At 85k a year at 15% flat tax that’s an effective tax of 12.85% and with the progressive its about 13.03%. The majority of Americans do not make 85K a year according to Figure 2 below.

As you can see the percentage of households that make less than $75000 a year even is about 57.3%. So over half the populations would be punished for making less, and effectively the less you make the more you will be punished. So even though a flat tax can be objectively fair in specific situations, in reality the amount of money the US would need to collect in taxes would most likely never allow for a flat to tax be something that is viable in the US. And an implementation of a flat tax most likely result in a regressive tax model if all over aspects of the tax code remind the same, where the super ultra rich and mega corporations continue to dodge trillions of dollars in their tax burden. Basically, before a flat tax could ever be proposed in the US, many tax code loop-holes would have to closed in order to keep the tax rate low enough to have it make sense for the US population overall. I will probably do another blog post about tax codes that allow for these loop-holes to be taken advantage of by the super rich.

So even though our current tax code is not fair, there is no arguing that, it is far more fair then the alternative of a flat tax above 10%.

TL;DR: Its not fair, the more you make the more you are taxed. But a flat tax would most likely end up screwing over the poor more since the amount of money needed to fund the US government is a good bit of money. And the super rich top percent of the 1% don’t think its fair they have to pay any in taxes so a flat tax would most likely get lobbied into a horrific situation for poor people and the country overall. Fix those loop-hole damn it!